Understanding Your Rates Notice

Most information on your rates notice should be easy to understand. However, we recognise that some detailed financial information can be more challenging.

Here are a few explanations to better understanding your annual rates notice:

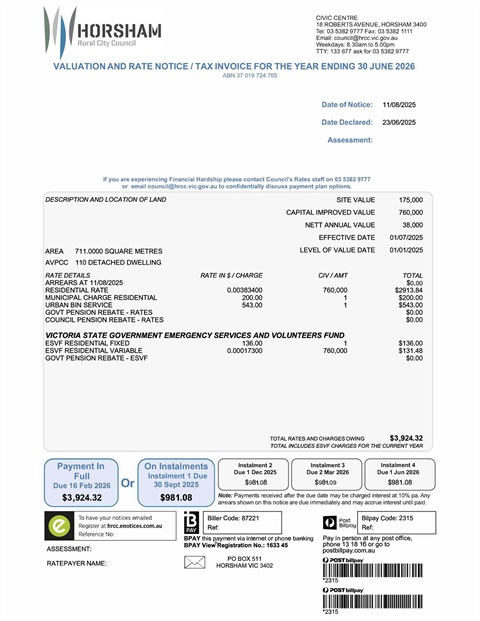

- Property valuation

This section of your annual rates notice outlines the value of your land and property. Council use the Capital Improved Value to calculate your Rates. Council is not involved in deciding how much a property is worth, all valuations are undertaken by the Contract Valuer who is appointed to Council by the Valuer General Victoria.

- Site value

Site value (SV) is the value of the land only and does not include the value of any improvements such as buildings.

- Capital improved value

Capital improved value (CIV) is the assessed market value of both the land and any improvements such as buildings.

- Net annual value

Net annual value (NAV) for residential and primary production properties is five per cent of a property’s CIV. For non-residential properties, NAV is the greater of either the estimated annual market rental of the property minus all legislated expenses to maintain that property (except council rates) or five per cent of CIV.

The “Rate Detail” section of your annual rates notice outlines the different expenses listed in your rates notice:

- Arrears at date of issue

This line item shows any rates or charges that have been carried over from the previous financial year. A credit will be shown as a negative amount eg. -$x,xxx.xx

- General rates

General rates are collected by Council to fund all of the services provided by Council other than those included in the separated waste service charges. This includes libraries, leisure centres, maintaining our parks and public spaces and much more.

- Municipal Charge

Council collects the municipal charge as a flat charge that is used to offset some of Council’s administrative costs and ensures that all properties make a standard contribution.

- Waste charge

The charge for an urban or rural residential property with a bin service and, Commercial properties that choose to have a bin service through Council.

- Emergency Services and Volunteers Fund

This is a mandatory Victorian State Government charge not a Council charge. It is collected by local Councils on property rates notices to fund a wider range of emergency services, replacing the Fire Services Property Levy from 1 July 2025.

- Total

This is the total amount owing to Council for 2025/26.

Payment options

Rates can be paid in full or in quarterly instalments.

You can pay your Council rates (as well as animal registrations and debtor bills) via Post Billpay using your Mastercard or Visa card online and quoting the Billpay code and reference number on your notice.

You can also make payments by using BPay through internet banking.

Payments can also be made in person at any Australia Post Office or during office hours at the Civic Centre, 18 Roberts Avenue, Horsham.

For more information.

If you haven't received your notice, you can request a copy here.

For all other information about your rates, including registering to receive your notices by email, click here.

For all queries regarding the Emergency Services and Volunteers Fund (ESVF), please call the Victorian Department of Government Services support line at 1300 819 033.

If you are still unclear about your annual rates notice, or if you are experiencing financial hardship, you can contact the Horsham Rural City Council customer service team on 5382 9777.